It would be hard to find two landscapes in the continental United States more different than the flat, arid desert of California’s Imperial Valley and the forested, stream-laced mountains of western Maine.

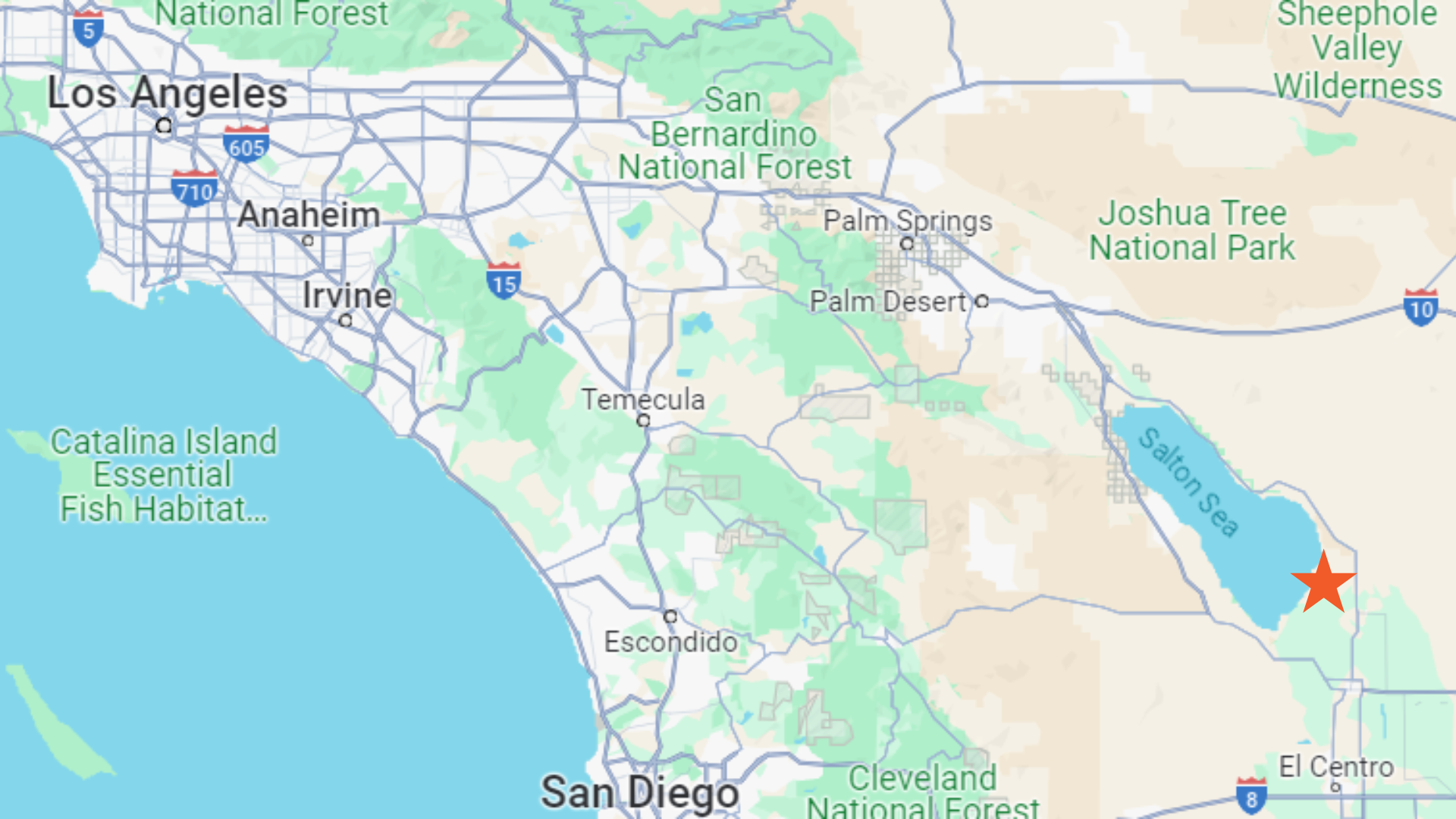

In late winter, while Maine’s ground is blanketed in snow, a patchwork quilt of irrigated fields covered with salad crops and hay stretch to the horizon in the Imperial Valley and to the Salton Sea, a 35-mile long, landlocked lake near the Mexican border.

But beneath the surface, western Maine and the Imperial Valley share something in common — nationally significant deposits of lithium.

It’s a strategic metal considered essential for batteries that power electric vehicles and the storage systems needed to support a global, renewable energy revolution.

News reports have highlighted the Maine discovery said to be one of the world’s largest deposits of lithium, locked in rock crystals on the side of Plumbago Mountain in Newry.

Meanwhile, lithium found thousands of feet underground in the superheated, salty water called geothermal brines is making global headlines.

There’s enough lithium contained in the brines around the Salton Sea for 375 million batteries for electric vehicles, according to a recent federal analysis. It’s enough to help the U.S. meet global demand for decades, the analysis says.

Only 2% of the world’s lithium supply now comes from the United States. Most comes from Chile, Argentina, Australia and China, with much of the processing taking place in China. So there’s a huge effort to ramp up domestic production for national security and economic reasons.

As America scrambles to develop a resource sometimes called the “new oil” or “white gold,” contrasts are emerging between what’s happening in western Maine and southern California. In a nutshell, Maine is moving cautiously to consider a single mine while California is well on the way to hosting a multi-billion dollar industry.

Maine has not been friendly to mining. The state’s metal mining laws, revised in 2017, are among the strictest in the country. No modern mines have been developed in decades, and no company has applied for a metallic mining permit from the Department of Environmental Protection since the law was passed.

Wolfden Resources Corp., a Canadian company aiming to mine for zinc and copper near Pickett Mountain, was recently turned down by the Maine Land Use Planning Commission in its request for a rezoning, the first step before the company could apply for a mining permit. That is the closest any company has come to testing the state’s regulations.

But Maine may be more receptive to a lithium mine. On Wednesday, the citizen board that oversees the Maine DEP voted unanimously to adopt changes to the mining law that would exempt some metals from the state’s strict metallic mining regulations, provided developers can prove they won’t pollute nearby watersheds or cause other environmental harms.

Chemical processing would still be regulated under the metallic mineral mining law. The changes are expected to go back to the legislature for approval in the coming weeks.

While Maine cautiously considers a way to permit a lithium mine, pilot projects aimed at extracting lithium on a large scale are well underway by California’s Salton Sea.

Global investors and major automakers are spending billions on what they say will be the world’s cleanest, major source of lithium extraction. Some boosters have dubbed the area, “Lithium Valley.”

What’s happening in California could ultimately impact the future of lithium mining in Maine and other places by raising a critical question: If new, lower-impact technology can tease out global supplies of lithium from geothermal brine, is it better to leave rockbound deposits in the ground?

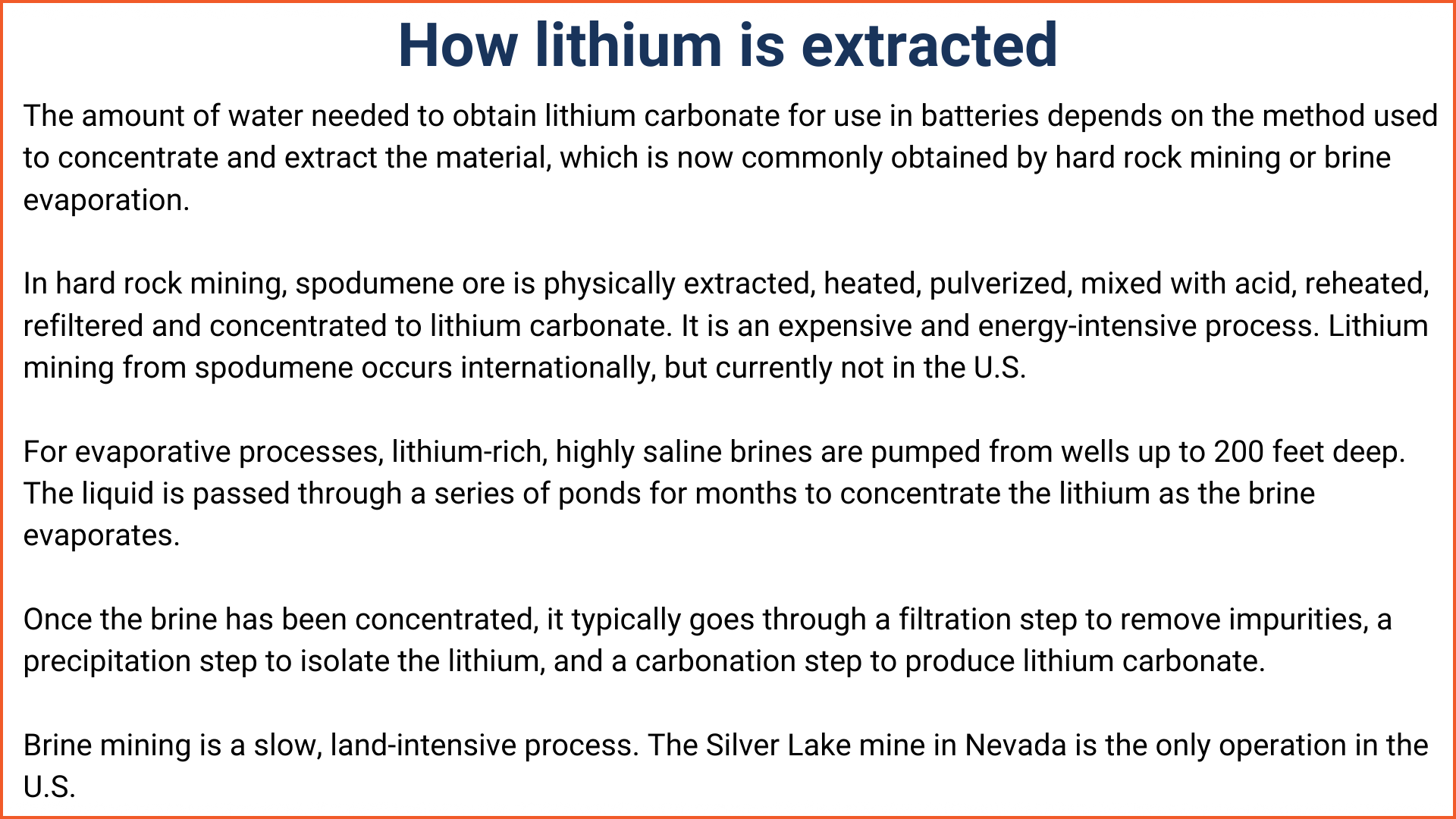

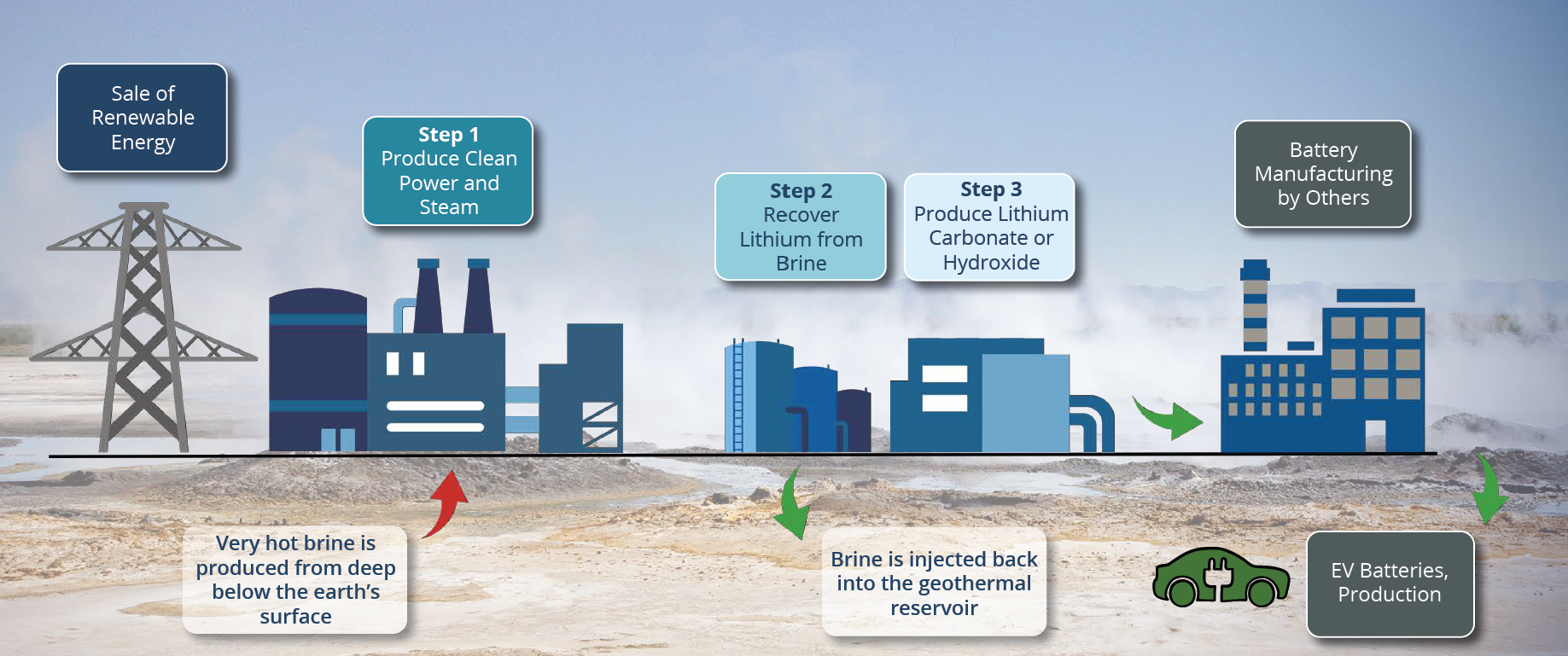

This question came to the fore because of activity at geothermal power plants at the southern edge of the Salton Sea. For more than 40 years, geothermal plants near the lake have pumped the 500-degree brine, using the steam to spin turbines and injecting what’s left back underground.

Today there are 11 power plants with a total generating capacity of 400 megawatts, enough to power 300,000 California homes, with more plants planned.

But until recently, the millions of tons of dissolved lithium in the brine were pumped back into the earth, unused.

Now three operators are at various stages of extracting lithium from the salty water using technology known as Direct Lithium Extraction, or DLE, which they say could bring their pilot projects to commercial scale.

If they succeed and the methods are financially viable, proponents say the process could capture lithium with lower environmental impacts than hardrock mining, while generating clean, renewable energy.

The projects, however, are not without controversy, in part because large volumes of water are used in extraction processes. An investigation by the Howard Center for Investigative Journalism, reported in February in USA Today, reviewed 72 proposed mine sites and found most would take billions of gallons of water from already stressed resources such as the Colorado River. That’s the largest source for Salton Sea projects.

There’s also pushback from residents in the impoverished Imperial Valley, who already struggle with elevated health problems. In January, the nonprofit Comite Civico del Valle announced its intent to sue to overturn permits for a proposed lithium production campus, citing concerns over water use and air pollution from construction and operations.

Meanwhile, developers and investors are in a race toward commercial viability. Three major players are taking the lead.

Berkshire Hathaway Energy Renewables: This Warren Buffett-led company’s subsidiary runs 10 geothermal plants. It has worked since 2022 on a process to recover lithium at a demonstration plant and produce battery-grade lithium carbonate.

EnergySource Minerals: This company is developing Project ATLiS at the 55-megawatt John L. Featherstone power plant. It’s using a patented extraction process and is aiming to be in full operation in 2025. Last year it signed a supply contract with Ford Motor Co.

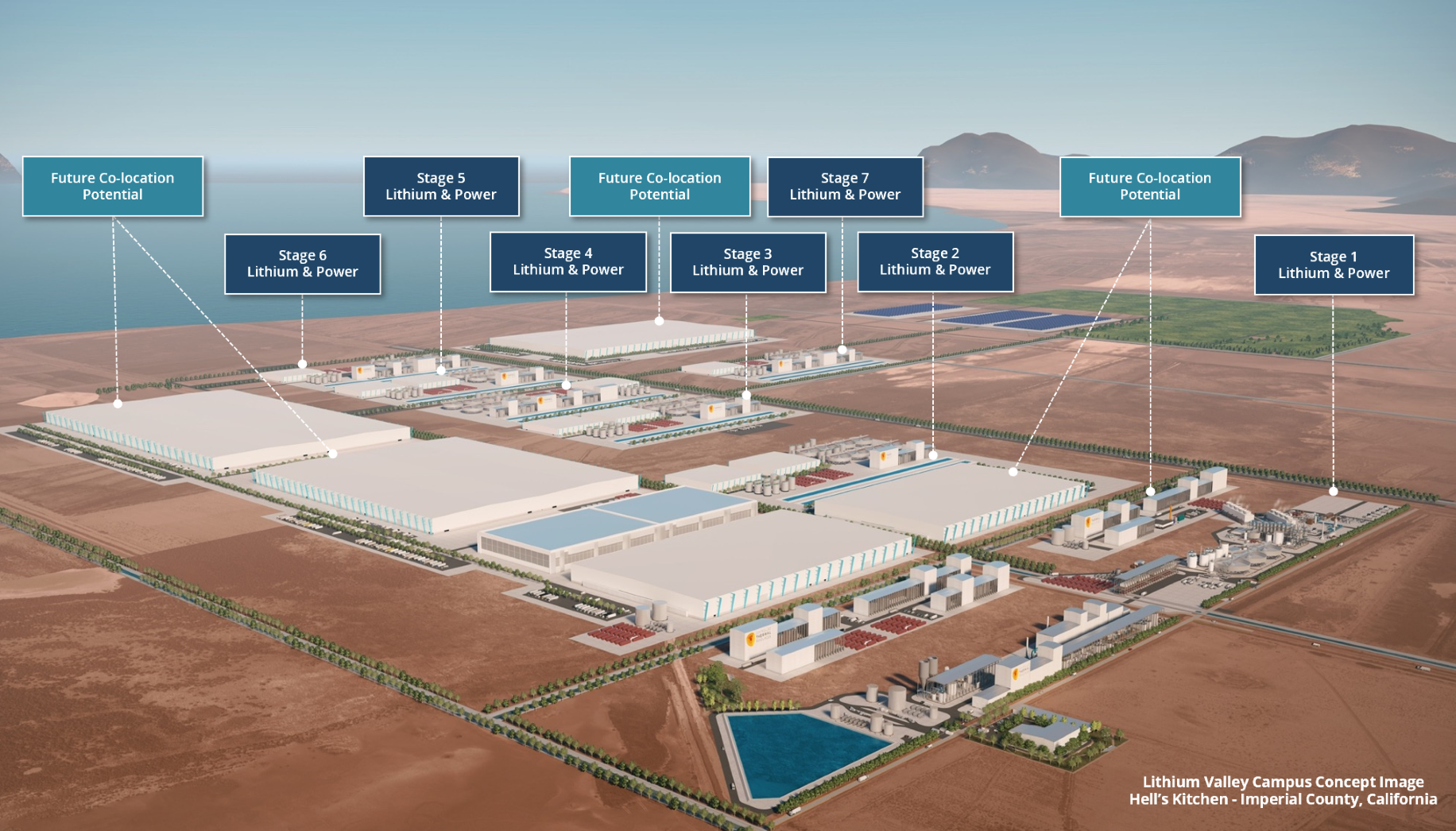

Controlled Thermal Resources: This company held a groundbreaking ceremony in January to launch its $1.8 billion Lithium Valley campus, billed as the world’s first fully integrated facility to extract and process lithium, possibly with on-site battery manufacturing and recycling plants.

The project is called Hell’s Kitchen and the company says fully realized, it could represent a $28 billion capital investment and support nearly 8,000 jobs. The company has entered into investment and supply agreements with General Motors, and has received $100 million from Stellantis, the parent company of Jeep and Chrysler, to advance development.

In late January, Biden administration officials were among those at a groundbreaking for the first phase of the planned Lithium Valley production campus.

“This administration supports the vision of Lithium Valley,” said John Podesta, Biden’s climate czar, during remarks at the event, “and it’s not just winning the (lithium) race, it’s about providing good-paying jobs.”

A game-changing technology

Direct Lithium Extraction isn’t a new process. But the latest techniques to filter lithium from the salty, mineral rich brine and create a sustainable industry in tandem with geothermal power plants, is a game-changer, according to Michael McKibben, a research professor at the Department of Earth and Planetary Sciences at University of California, Riverside.

“We should never mine lithium from hard rock again,” he said.

McKibben, who contributed to the federal analysis, said the key issue is the economics of bringing the extraction processes at the Salton Sea to commercial scale.

“I think ultimately, if DLE can be scaled up successfully in many places, it will put hard rock mining out of business. It may take a decade, but I think the writing is on the wall.”

Not everyone agrees that the Salton Sea projects represent a disruptive technology.

“Do I think what’s going on at the Salton Sea will replace any or all lithium mining in this country?” said Corby Anderson, a professor and associate director at the Colorado School of Mines. “No, I don’t. It’s not a panacea. It’s an opportunity.”

Anderson said supporters downplay the technical challenges and costs of recovering lithium from a thick brine loaded with compounds and minerals. And he said public opposition to mining often is based on perceptions that linger from polluting practices no longer used.

“Modern mining,” Anderson said, “it’s not like all the dirty pictures of the past.”

Is Maine’s lithium still worth mining?

Mining is cleaner than it used to be. But with so much potential and investment already taking place at the Salton Sea, is mining in Maine needed for the U.S. to develop sustainable supplies of lithium?

Yes, said Mary Freeman, the co-developer of the Plumbago North project.

“If mining can be handled in an environmentally responsible manner,” she told The Maine Monitor, “what is the value of excluding Maine from participating in a viable sector of the economy?”

Freeman and her husband, Gary, are gemstone miners who split their time between Maine and Florida. They want to expand the pit they developed near Newry to mine lithium-bearing spodumene minerals from a deposit some experts estimated could be worth $1.5 billion.

They plan to ship it out of state for processing, which would avoid the waste products that could threaten Maine water supplies.

Freeman said their project is on hold, awaiting legislative acceptance of the proposed amendments to Maine’s mining regulations.

But she said development of additional domestic resources such as the Salton Sea doesn’t diminish the value of mining the spodumene at Plumbago North, which contains large crystals with both high lithium oxide and low iron content. These materials can be used for products such as scientific glass, used in computer and cell phone screens.

This sentiment reflects the notion that market competition will lead the U.S. to develop a range of domestic lithium sources. That’s likely, according to Patrick Dobson, a lead geological scientist at Lawrence Berkeley National Laboratory and chief author of the federal analysis done for the U.S. Department of Energy that characterized the geothermal resource and lithium potential at the Salton Sea.

Dobson is aware of the Plumbago deposit and monitors efforts to extract lithium and other critical minerals from geothermal, hard rock and clay deposits. They include:

Silver Peak, Nevada: Albemarle Corp. has produced lithium from brine deposits for decades at what is, for the moment, the country’s only active lithium mine. Lithium is concentrated through evaporation in a series of ponds. The company plans to double production, even as opponents say it’s depleting the area’s aquifer.

Clayton Valley, Nevada: Canadian-based Century Lithium Corp. is working to advance a lithium brine project near the Silver Peak site. The Clayton Valley project is conducting pilot plant operations and has a processing operation elsewhere in Nevada.

Thacker Pass, Nevada: This mine, on the Oregon border, is at one of the country’s largest lithium deposits. Native tribes and environmental groups fought it but pre-construction has begun. General Motors is investing $650 million for rights to the lithium supply and now is the largest shareholder. It previously was owned largely by Ganfeng Lithium Group of China.

Lithium potential isn’t limited to the arid west. Piedmont Lithium is seeking to develop a project in North Carolina, in a forested area west of Charlotte that is more like Maine. The company describes the area as the “Carolina Tin Spodumene Belt.”

The company has asked state regulators for more time to conduct feasibility studies. The proposed open-pit mine faces opposition from Gaston County residents concerned with water pollution, groundwater levels and other concerns.

These and other projects illustrate the soaring demand for battery storage and political pressure to develop domestic supplies. But Dobson said it remains to be seen which ones come to fruition.

Whether Maine stays in the mix may be decided in the weeks ahead.

“Which lithium projects turn into actual commercial developments,” he said, “will depend on a variety of factors, such as local acceptance, environmental approvals and the commercial viability of each project.”