On the road to all-renewable power, Maine is moving like a car near the base of a long, snowy hill. It’s accelerating now, knowing it may lose momentum and traction in the ascent. One icy patch that could slow its progress is the recent congressional decision not to extend tax credits for solar panels or new electric vehicles (EVs).

Tax credits for renewable energy are popular across the political spectrum, which makes the action by Congress particularly nonsensical. A survey done last fall by the Yale Program on Climate Change Communication found that more than two-thirds of respondents favored “providing tax rebates to people who purchase energy-efficient vehicles or solar panels: 82 percent of registered voters, 95 percent of Democrats, 68 percent of independents, and 70 percent of Republicans.”

The proposal to extend tax credits had significant bipartisan support in Congress and likely would have passed as part of the spending package, but the White House objected — risking the prospect of a government shutdown.

So now Maine, as it gears up solar generation following passage of LD 1711 last June, will gradually lose the boost given by federal tax credits. Rep. Seth Berry (D-Bowdoinham), co-chair of the Legislature’s joint standing committee on energy, utilities and technology, views that federal decision as “unfortunate” – given the climate crisis. But he and others are convinced that while the federal ramp down may slow Maine’s progress toward 100 percent renewable energy, it won’t stall it.

“States can do a lot in the absence of leadership in Washington,” he says.

SOLAR-POWERED EDUCATION: Schools around Maine are taking advantage of federal solar tax credits before they ramp down further. In this video, producer Charles Stuart profiles staff and students at Camden Hills Regional High School in Rockport, where the school has installed solar panels and a wind turbine on the school property and signed a power purchase agreement for an additional solar project off-site. The new Camden-Rockport Middle School, still under construction, will use heat from a nearby wastewater treatment plant. As Stuart reports, it all adds up to significant savings for the school district — alongside reduced carbon emissions.

Limited Time Offer

The ramp down of solar tax credits is “not really affecting the growth opportunity” that solar companies see in Maine, observes Shawn Rumery, director of research for the national Solar Energy Industries Association. “The industry has gotten to a point of maturity where we’re far less reliant on what’s happening in Washington.”

The prospective loss of those credits is actually stimulating a rush to initiate projects before the incentives expire. Many municipalities across Maine, along with school districts in communities such as Mount Desert Island, Portland, Islesboro and Camden/Rockport (see video), are taking advantage of new solar construction while they can still benefit from power purchase agreements (PPAs) with third-party investors (who use the federal tax credit and make solar installations a no-money-down proposition).

PPAs are typically structured so that after six years, the district or municipality can purchase the solar panels at a discounted rate from the investors and generate their own power. Over the panels’ 20-year lifespan, this arrangement can lead to significant energy savings. The MDI school district, for example, projects that its 425-kilowatt installation will save the district more than $1 million.

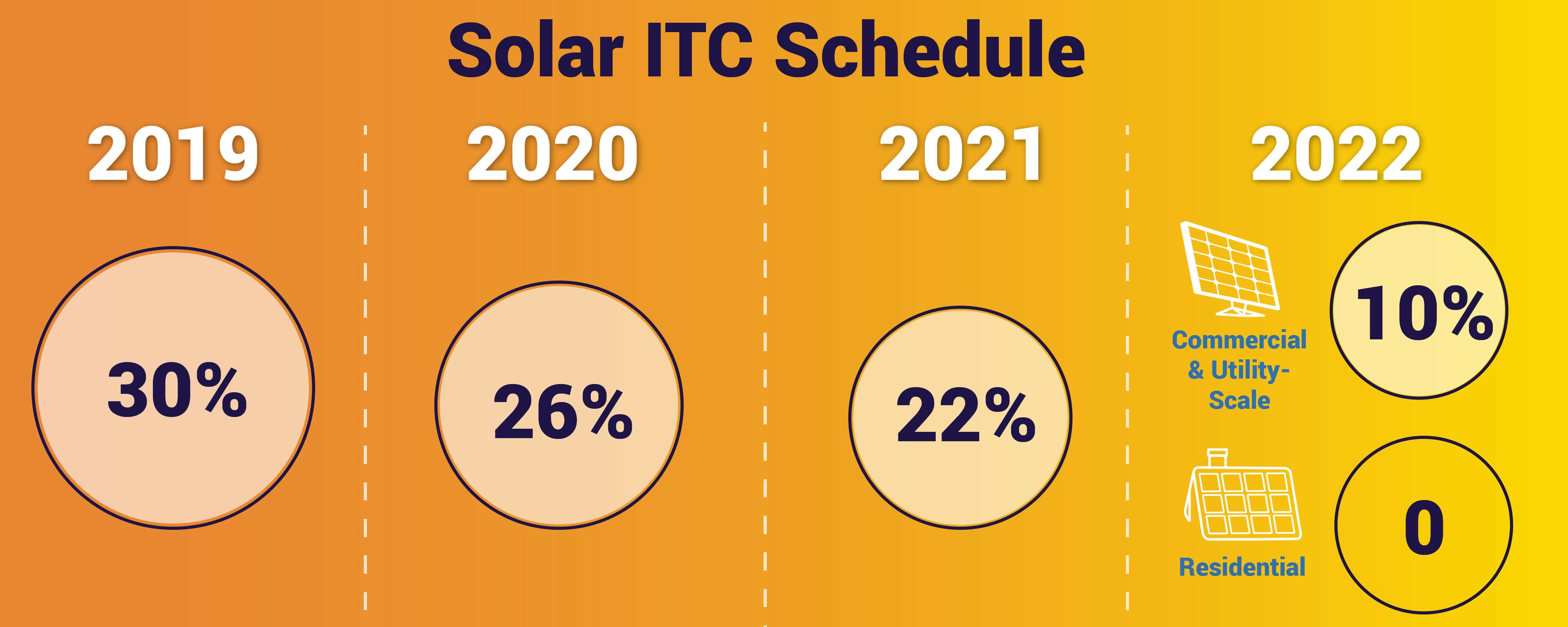

While the solar rebate already has fallen this year from 30 to 26 percent, Fortunat Mueller, a managing partner of ReVision Energy, anticipates that the drop in 2022 to 10 percent will have a “much more significant” impact.

The declining federal tax rebates were premised on the assumption that solar prices would fall markedly, and they have: 99 percent over the last four decades. But tariffs imposed by the Trump administration have counteracted that cost decline and “consumed all the improved economics for the past two years,” Mueller notes. What the industry calls “soft costs” – those for utility interconnections, permitting and workforce development – remain high, he adds.

Convincing Consumers

As to the federal decision not to extend EV tax credits, “in some ways that’s a bigger deal” for Maine, notes Dylan Voorhees, climate and clean energy director at the Natural Resources Council of Maine. “Actual costs are coming down, but not as fast as the rebates are expiring.”

The $7,500 tax credits on EVs are phasing out as manufacturers reach the target of 200,000 vehicles sold that was set in the initial legislation. Tesla and GM have passed that mark and Nissan anticipates reaching it next winter. Mueller faults the original legislation for having “an incredibly bad design … to punish companies that are successful.”

Even Nissan anticipates a “big impact” from the phaseout given relatively low gas prices, says Jason Moore, EV operations manager for the company’s Northeast region. Battery prices have fallen, he acknowledges, but some of those savings are counteracted by added safety and technology features.

With a flood of new EV models coming to market, Michael Stoddard, executive director of Efficiency Maine, is “seeing pricing get more competitive,” particularly with plug-in electric hybrids (known as PHEVs, which rely on batteries for shorter distances and gas for longer trips). The step-down in federal tax credits is “not going to affect how we roll out Maine’s EV initiative,” he says.

Last August, Maine began offering a $2,000 credit ($3,000 for low-income buyers) — provided at purchase — on all-electric vehicles and $1,000 to $1,500 for PHEVs. “Before the (state) incentive, the numbers weren’t anywhere near where they are now,” Moore acknowledges. But “to get the adoption levels we need, the manufacturers, the (federal) government and the states (all) need to incentivize customers to go green.”

As a recent EV purchaser, I can attest to the power of those combined incentives. I would not have bought an EV now had only one or two of the rebates been in place. The combination of federal, state and manufacturer incentives took $14,500 off the base model price, making the cost equivalent to comparable gas-powered cars. It’s easy to envision how losing the largest piece of that mix — the federal incentive — could dissuade many potential EV buyers.

According to a recent report prepared for the Legislature on “beneficial electrification,” Maine needs to rapidly convert both heating and transportation from fossil fuels to renewable-powered electricity to achieve its ambitious goals for reduced carbon emissions. That conclusion is affirmed by energy consultant Richard Silkman in a new book that lays out a pathway for Maine to achieve a zero-carbon economy by 2050 “without increasing the total amount it spends on energy each year.”

The needed energy transition won’t happen through “benign neglect,” Silkman warns, but will be reliant on “government to create the necessary financial incentives and organizational structures.” In the face of declining federal support, Maine can maintain momentum in its energy transition by providing stronger EV incentives, more streamlined approaches to solar permitting and grid interconnections, and programs to develop the workforce needed for a renewable energy economy.

With those measures providing added traction, Maine could yet make it up the coming hill.