If you are reading this online and not in a print newspaper, you can easily understand why Sears and other retailers are closing stores across the country.

People purchase more services than goods. News is a service. You can get it online and avoid the need to pick up a paper at the local store.

How newspapers work economically is changing quickly, hardly leaving time for publishers, advertisers and readers to adjust. Just last week, one of the largest newspaper chains filed for bankruptcy.

You went to Sears for a screwdriver or a refrigerator. But you don’t go to a department store for services like health care or retirement living, among the fastest-growing markets.

The number of both newspapers and retail stores is declining. The Sears store in Brunswick is closing, leaving only one of the company’s stores in Maine. If Sears can’t make it in the country’s most rural state, it seems likely soon to disappear.

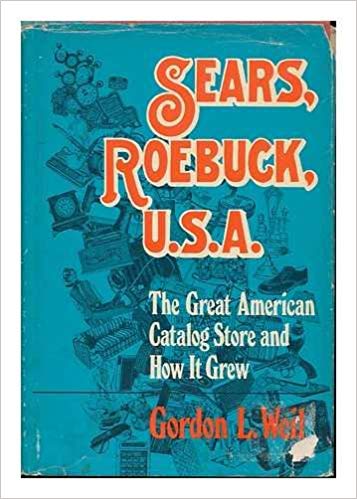

In the 1970s, I wrote the unofficial, corporate biography of Sears, Roebuck. It was published just at the high point of the company’s history. The potential loss of the chain’s retail dominance was evident even then, but it failed to adjust.

Just as the Sears catalog brought a huge array of products into the most remote homes, the internet has expanded the range of products and services available and reaches almost all homes and businesses.

Rural Free Delivery, once a revolutionary innovation, was long ago replaced by the United States Postal Service as the final delivery arm of private companies like FedEx and UPS.

Amazon is the new Sears. Walmart, with stores all over the state, has made the move to compete electronically. Ordering online and picking up at the store is growing. Electronic retailing should keep gaining.

Yet it seems a bit too simple to conclude that electronic shopping is replacing the 9,000 stores that closed last year and the 1,200 closings already announced this year. Online sales are only 11 percent of the total retail market, according to the U.S. Department of Commerce.

The rapid rise of online sales represents change occurring at a fast pace in the economy, as in many other aspects of life. The reasons for the decline of retail stores, especially smaller shops, go well beyond the ease of shopping with your thumbs on a smartphone.

The change in the distribution of income impacts the retail market. If people have less to spend, they reduce their shopping. That’s evident these days with people holding onto their cars much longer than in previous years before buying a new model.

While national income has risen, the gain has not gone to the middle-class shopper who is the principal customer of retail stores. The middle-class contribution to the national economy is steadily decreasing.

Middle-class Americans have less money to spend on extra items even though they spend all they make.

Retail merchants focus on people with less to spend. The huge growth of “dollar” stores is a reflection of the market moving to provide inexpensive products to shoppers of limited means.

Most of the income gains have gone to the top 10 percent of the population. They do not spend all of their added income on shopping. Instead, they save a large part of their income. It goes into investments, which have flourished.

The combined effect of the changing distribution of income — revealing a shift from the middle class to the wealthy — and the rise of online sales has hit companies like Sears.

There’s an increasing recognition of the growing income and wealth gaps between the rich and everybody else. If that seems unfair, political candidates are ready to offer proposals to boost taxes on the wealthy.

Changing income distribution could affect government funding and reduce the exploding national debt, but it could also have a less obvious economic impact. Tax relief for the middle class, if funded by higher taxes on the wealthy, could allow the middle class to recover some of its lost purchasing power.

Politicians promise “jobs, jobs, jobs,” but with the current full-employment economy, having a job does not alone guarantee prosperity. And retail jobs are being lost when stores are forced to close as they lose their markets.

Tax cuts boosting the wealthy and higher tariffs on goods but not services are tools from the past, designed to keep the economy growing. The private sector may create new opportunities, but it may not add new jobs.

Sears failed to adjust to a changing economy and to the rapid pace of change. Its demise sends a warning to the broader economy and to the government that anticipating change and adjusting to an electronic, service-oriented economy is urgently needed.

The closing of the Sears store in Brunswick is not an isolated event. It is a sign of major economic change that will be ignored at peril to the economy.