Switching on a light, you may not think about where that power is coming from – whether a gas-fired generating plant, biomass boiler, hydropower facility or one of the new solar farms springing up across New England. To the end-user of electricity, the system looks and acts much as it has for decades. But on the generation side, rapid change is under way with a renewable power boom that will soon transform how the grid operates, and how we – as consumers – use electricity.

Envisioning that grid of the future (the subject of my next column) requires a basic understanding of how renewable energy is changing the electric power landscape. This sphere is complex and littered with acronyms, but I’ll try to map out some parameters that could be useful as you choose a “competitive electricity supplier” for your home or business, consider subscribing to a community solar farm, assess the performance of your electric utility or consider collective policy decisions like whether Maine might be better served by a consumer-owned utility.

RECS: The currency of renewable power generation

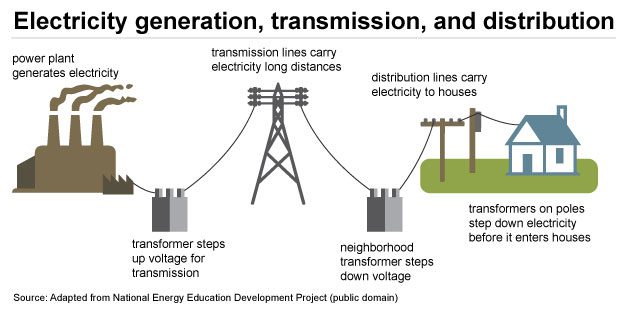

Let’s begin back at that light switch. Unless you live off-grid, the power in your home has come from a distant electric generator through a series of high-voltage transmission lines and low-voltage distribution lines. Whether fueled by renewable sources or fossil fuels, electrons all flow together through the grid indistinguishable as to source. There is no feasible way to designate “green” electrons.

So how do regulators determine how much electricity is coming from renewable sources? And how can businesses claim to be powered by clean electricity?

Renewable power is tracked using renewable energy certificates (RECs) issued to the generator that can be bought, sold and banked like currency, or retired. Renewable power generators earn one REC for every 1 megawatt-hour (1,000 kilowatt-hours) they produce, and they can sell both their RECs and their power in different markets.

Each REC receives an identifying number and is registered with a regional tracking entity (the New England Power Pool Geographic Information System in the Northeast). The price of RECs in each state is set by supply and demand, both shaped by a state’s energy and environmental policies.

RPS: The driver of new renewable power generation

RECs are how Maine and other states track progress toward renewable portfolio standards (RPS), laws that specify what percentage of the state’s electricity consumption must come from renewable power supplies. By one estimate, these policies – operating in more than 29 states – have driven roughly 60 percent of the new renewable generation and capacity added since 2000. That wave has been boosted by steep declines in the cost of solar and wind technology, net energy billing and federal tax incentives.

In 2019, the Maine Legislature directed that Maine’s RPS, currently at 40 percent, reach 80 percent by 2030 and 100 percent by 2050. “Over time, as RPS requirements step up, that will create an increased demand for RECs that will support the development of more renewable projects,” said Faith Huntington, director of the electric and natural gas division at the Maine Public Utilities Commission (PUC).

At first glance, Maine would appear to be doing well relative to those targets. Roughly 80 percent of the electricity generated in the state during 2019 came from renewable power. Many of the RECs earned for that generation, though, are bought by utilities and electricity suppliers out of state to meet their RPS requirements. Consequently, Maine suppliers import much of their electricity from the New England market or New Brunswick – which typically source their supply from oil – or gas-fired generators.

Despite Maine’s high level of renewable generation, fossil fuels constituted 83 percent of the supply for CMP’s standard offer service during much of last year, according to a mandated disclosure label. That would seem to violate the state’s RPS standard, but Maine permits varied generation sources to meet its RPS, including cogeneration plants that are often fired by fossil fuels (a definition of “renewable power” that stretches the bounds of credibility).

As RPS requirements increase, driving up the demand for and cost of RECs, consumers will likely see a higher percentage of renewables in those mandated disclosures; “that’s how actual fuel mix will change to more renewables,” Huntington affirmed.

Not all renewables are equal

RECs are awarded to all generators that a state defines as renewable, and Maine has a big-tent approach that includes hydropower (as long as fish passage is permitted), despite its environmental impacts, and biomass plants, which many scientists argue are not a carbon-neutral, clean form of energy. Other states in the region set higher standards for hydropower and biomass plants to be eligible for REC credits.

In recent years, most of the renewable power Maine used to fulfill its RPS requirements came from hydropower and biomass. For 2019, the most recent annual data shown on the PUC website, 89 percent of what was used to satisfy Maine’s RPS for Class I generation (governing newer facilities) came from biomass; hydropower accounted for 94 percent of Class II generation (governing older facilities).

Solar power did not register in either class and wind represented less that 1 percent in the Class I category. That should change in the coming years.

With RPS ramping up quickly and a growing commitment to electrify heating and transportation, Maine will need significant new generation to meet its targets beyond 2026, according to a recent assessment consultants prepared for the governor’s Energy Office. That report estimated that Maine would likely need “new builds (of wind and/or solar) between 800 and 900 megawatts by 2030.”

Since last summer, the PUC has approved 24 contracts for renewable power projects with a total generating capacity of 781 MW. The contract prices are in the range of current and projected wholesale market prices, which are generally driven by natural gas plants, according to Mitch Tannenbaum, the PUC’s legal counsel. Projects are selected based on the lowest price and the economic benefits for Maine. Large-scale solar projects dominated both recent procurements.

Working toward a strategic vision

Maine lost eight years under Gov. LePage, during which time other states were expanding their renewable energy capacity and starting to assess what grid changes were needed to accommodate cleaner power. Since 2019, the state has moved quickly to stimulate renewable generation, positioning it to meet the ambitious RPS targets set that year.

With electricity use forecast to grow markedly and climate goals that require the added power come from new renewable energy, Maine will need to get more strategic about how to combine that generation with energy storage and demand response programs (like time-of-use rates). The next column will explore how Maine can achieve that integration through a modernized grid.