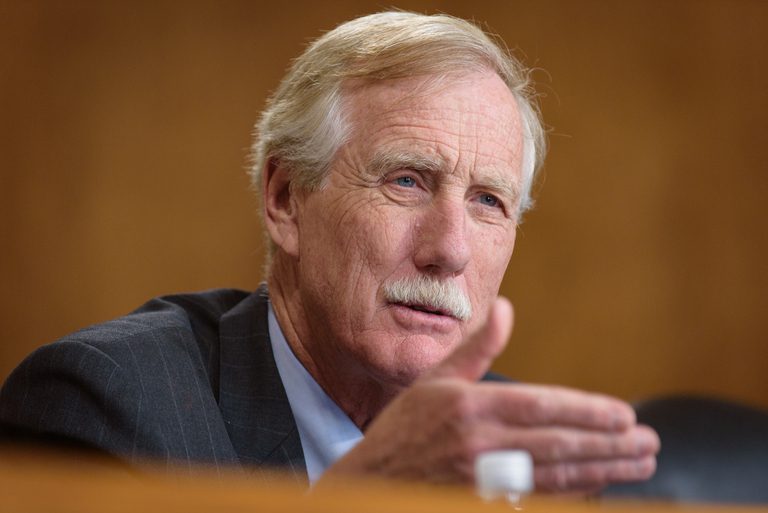

In promoting his independent candidacy for U.S. Senate, Angus King claims credit for improving the financial condition of the state’s pension funding during his two terms as governor.

The accuracy of the claim, made on his campaign web site, is important because Maine, like most states, has a history of going deep into debt due to poor financial management of the multi-billion-dollar program.

The Maine Center for Public Interest Reporting examined the claim for accuracy and completeness, relying primarily on records from the Maine retirement system and legislative studies.

The research shows that while the pension system finances improved while King was governor, a major reason wasn’t because of anything he did – it was because he was governor during the stock market’s glory years when the system’s investments went up double digits.

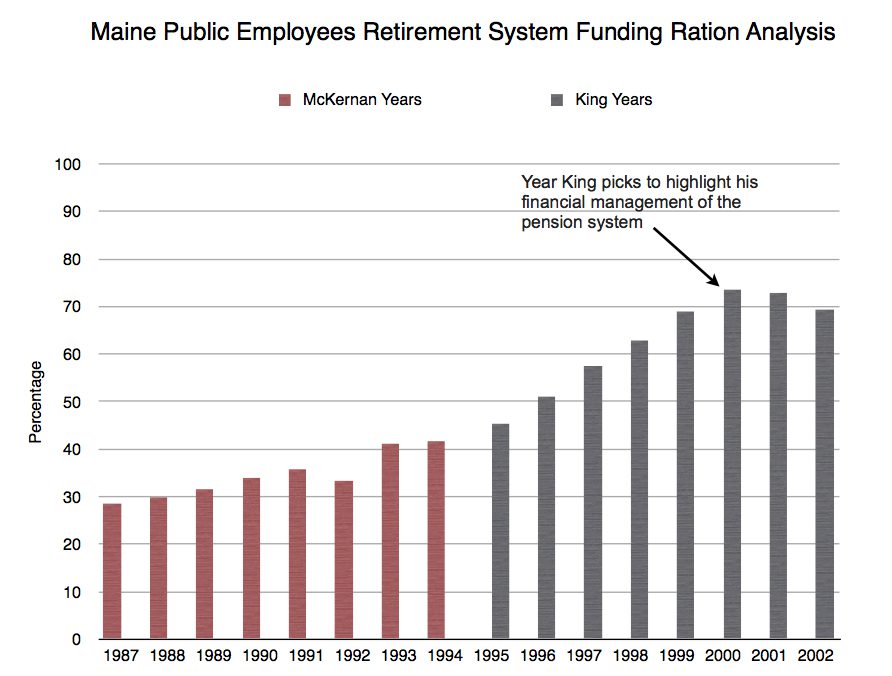

King’s use of statistics to make the case for himself have another problem: He counts only the first six years of the governorship, when the pension funding improved, and skips over the final two years, when the funding declined, although it was still better than when he took office.

King claimed on his campaign web site that he “Improved the financial condition of the Maine State Retirement System by increasing the Actuarial Liability funding from 45% in 1995 to 74% in 2000 and the Accrued Liability funding from 65% in 1995 to 100% in 2000.”

“Actuarial Liability” refers to whether enough money has been put aside to pay all future pension costs. Pension experts consider 80 percent fiscally sound. The “Accrued Liability” number shows if the state has put away enough money to pay its pension costs if everyone in the system retire immediately, and is more a reference point that a practical issue.

It is true that when King took office in 1995, the state had not put enough money aside to pay the pensions of the state employee and teachers. This funding gap is known as the unfunded actuarial liability, and it represents billions of dollars and costs as much or more every year than what the states spends on higher education, for example.

The underfunding pre-date King’s administration. The set aside money had become as low as 28.9 percent in 1987, but had been steadily improving between then and when King took office.

King took office in 1995, when the funding level was at 45.4 percent, as his campaign web site states. He then selects the year 2000 to cite how much things had improved while he was governor: to a funding level of 73.6 percent (King rounds up to 74 percent).

But those numbers don’t cover the full eight years of his administration – just 1995 to 2000. He was governor through 2002. If he had picked his final year in office, the numbers would not have been as impressive: 69.4 percent funding rather than the 74 percent he boasts of achieving.

Kay Rand was King’s chief of staff when King was governor and now serves as his campaign manager. She explained that the pension statistics cited on the King web site came from an “accomplishments memo” prepared by the state’s finance department in late 2001, which is why it does not include the final two years of King’s terms in office.

“We can go back and check that … and probably should have,” she said.

In an email to the Center, King wrote that the errors on the campaign web site were an “accident … I can personally assure you this was not deliberate … We put a lot of material together in a hurry at the beginning of the campaign and this one just got by me.”

King wrote that the “Angus 2012” web site uses “the 2000 data because that was what was available at the time it was written. When transferring the figures to the web page, she (Rand) didn’t focus on the 2000 date and neither did I when I approved the sentence in question.”

On Sunday, the King campaign corrected the reference to the pension on the web site.

The stock market effect

In the six years for which King takes credit for the pension funding improvements, the pension’s investment returns were between 13 to 25 per cent in all but one year, when the decline was about 4 per cent, according to a “Performance” report by the system.

A 2010 state-funded study of pension system notes that there were “17 years of continuous improvements in the Plan’s funded status” dating back to three years before King became governor, going through his two term and all the way into the second term of Gov. John Baldacci.

The report says the improvements were “attributable to two primary factors; 1) the State’s willingness to make the actuarial required contribution to pre-fund and fully fund the plan and 2) the run up of the bull markets during the 1990’s.”

King can take at least partial credit for the improvements because while he was governor he proposed legislation that put extra money into the retirement system so that the debt – in effect, a mortgage – could be paid down in fewer years.

King wrote that the pension funding analysis on his web site “should have extended beyond 2000 and the role of the market acknowledged (although our decision to shorten the amortization schedule (twice) as noted below had the effect of insuring that the market gains accrued entirely to the Fund and not in part to the General Fund which would have otherwise been the case).”

King, who was not a member of either party when he was governor, also supported a bill proposed by Democratic legislators that eventually led to the voters approving a change on the state constitution that required the state to pay off the pension by 2028 and prohibited the legislature from adding new pension benefits without also funding them.

Pension experts widely praise the constitutional amendment as an example of fiscal responsibility, although it didn’t solve all the problems. The 2006-7 recession caused another drop in the system’s funding status, prompting Gov. Paul LePage and the legislature last year to reduce pension benefits in order to avoid a eventual doubling of the annual pension costs.

The reduction meant that instead of the state paying $9.63 billion in pension costs between now and 2028, the cost will be $6.19 billion — a 35.6 percent smaller bill.