Editor’s Note: This is part one of a two-part series, The TIF Game.

Put an addition on your house, and the town assessor will come around, increase the value of your house and your property taxes will go up.

Put up a new store or factory, and the same thing will happen.

The greater the value of your property, the more you pay into the town coffers. That’s the money the town and school districts use to plow the streets, operate the police department and pay the teachers.

That’s how property taxes work for everyone – well, almost everyone. One select group gets a better deal because it has something called a TIF. And only a few select businesses have them in most towns.

Get a TIF, and you, too, have to pay taxes on that new warehouse or factory – but the taxes don’t help pay for the schools, plowing and cops.

Instead, the property taxes paid by a company with a TIF might build a new road or sewer line to the business. Or the tax money sometimes is returned to the business to help its bottom line.

All this comes under a little-understood and highly-technical program called Tax Increment Financing (TIF) created by the state in 1977.

A Maine Center for Public Interest Reporting analysis determined that since 1985 – the year TIFs became popular – the program has earmarked almost $2.8 billion in property tax revenues for diversion over the lifetime of those TIFs, which can last up to 30 years. Of that amount, up to $1.2 billion is or will be rebated directly to business. (The actual dollars granted may be less because the state’s database includes revisions as well as the original TIFs, creating some double counting.)

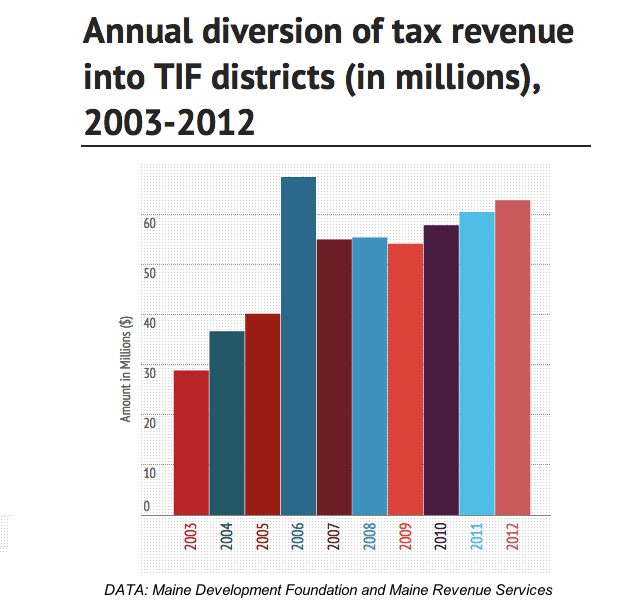

Considering just the most-recent 10 years, communities across the state have diverted $518 million in property taxes via TIFs, according to Maine Revenue Service records.

Documents and interviews with experts reveal that TIFs have evolved from a good government attempt to redevelop blighted areas to a tax loophole businesses can use to cut favorable deals with communities desperate for development, as well as a tax scheme towns use to maximize state aid.

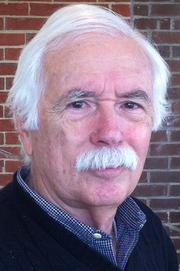

Orlando Delogu, emeritus law professor at the University of Maine, said the early TIFs performed an important function by encouraging redevelopment in Maine’s decaying mill towns and waterfronts.

“The debris of the past had to be cleared out of the way,” said Delogu.

“There’s nothing wrong with infrastructure improvements that enable you to attract an industry,” he said. “Those improvements benefit industry and society and the public will own it. It’s the sort of improvement that municipal government was created to put in place.”

But a second wave of TIFs granted in Maine allowed cities to give property tax payments directly back to developers, often with no specific public benefit in return. Almost $1.2 billion in property tax rebates have been granted under that part of the program, according to the Center’s analysis.

Those TIFs, Delogu said, amount to public money subsidizing private interests, with corporations “no longer having to bear the full cost of the capital investment they contemplate.”

A 2011 study on TIFs by the U.S. Public Interest Research Group stated that, “eagerness to bring in new development (or retain an existing business) … may lead governments to be overly generous in providing subsidies that are not justified by the level of public benefits delivered.” The Ford Foundation funded the report.

Those TIFs are characterized not by investments that benefit the public, but rather by private developers’ demands for cash — or they’ll take their business elsewhere or shut down, said Delogu.

“The thing is, if you deny them, they make the threat of going down the street” to another town, said Frenchville town manager John Davis, a former Millinocket city council member.

That’s just what happened in Hallowell, where in 2011 developer Peter Prescott asked the city to approve a TIF that would refund 100 percent of the property taxes for 20 years in exchange for rebuilding the Kennebec Ice Arena. The previous arena, also owned by Prescott, had collapsed under the weight of a snowy roof.

Prescott said his business needed the $1.2 million refund to help pay for the $4 million development.

City officials balked.

According to the Kennebec Journal, Prescott said he would consider relocating if he couldn’t get a deal in Hallowell. Prescott responded to two city councilors who objected to the deal, “Are you going to be a reasonable person, or are you going to get nothing?”

The city awarded a tax rebate of almost $500,000 over ten years to the arena, which re-opened in 2012. (It is now called the Bank of Maine Ice Vault.)

Similarly, when Bath Iron Works asked for a $6.36 million TIF last year to subsidize new construction at the shipyard, company officials said the subsidy was necessary to keep costs down and make the company more competitive and more likely to stay in Bath.

“Ships are awarded on the basis of lowest cost and BIW must do everything it can to be the low cost provider in order to win work that will secure our collective future in shipbuilding in the City of Bath,” stated an information sheet distributed by BIW.

The city council awarded the shipyard $3.7 million over 25 years.

TIF proponents cite examples of TIFs across the state that have helped create taxable property that ultimately benefits the public.

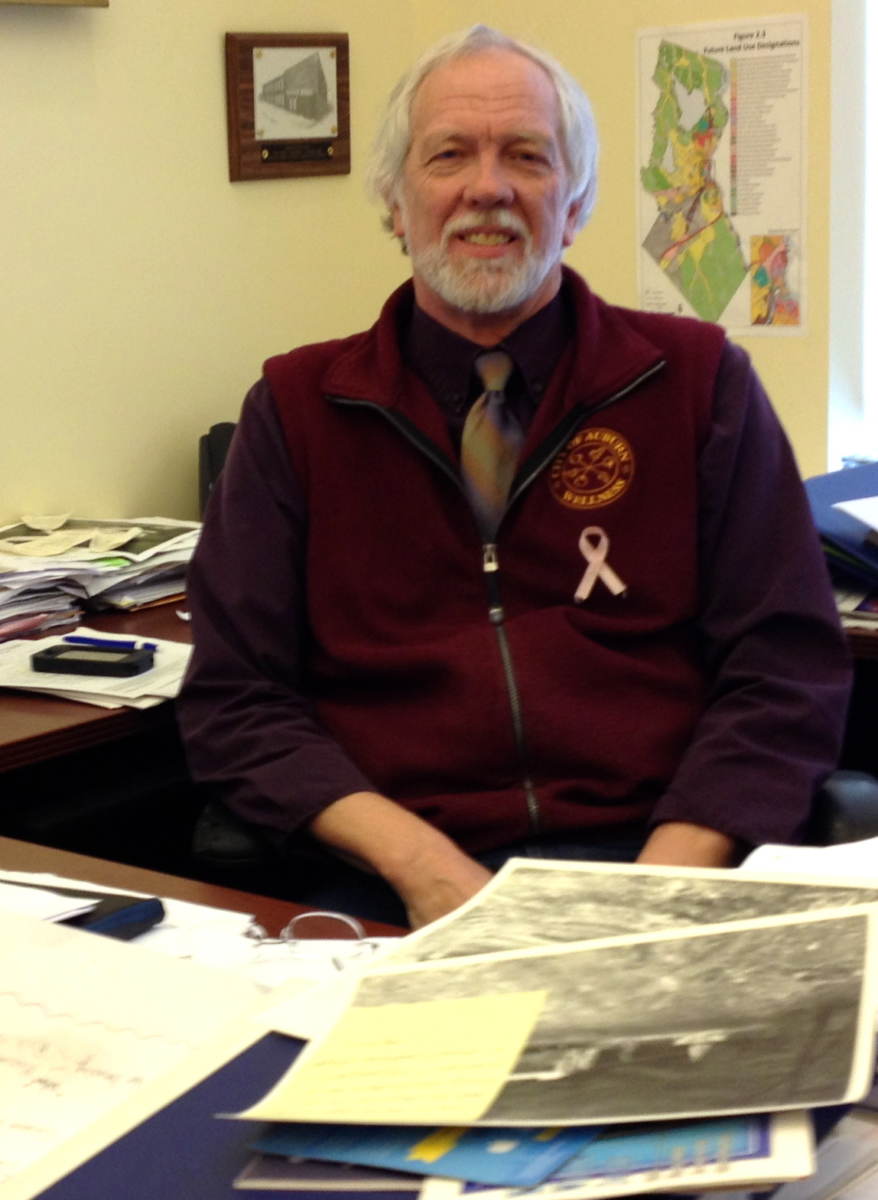

One of the state’s earliest TIFs happened in Auburn in 1984, when developers were considering several projects. But the area where the new businesses wanted to locate, near a highway interchange, had no modern sewer or water lines.

So the city’s economic development director, Roland Miller, got moving.

His goal: Extend public sewer and water lines to the area.

His method: A TIF in which Auburn paid for the utilities extension with a long-term loan and then used the taxes paid by the developers on their new construction to pay off the bonds.

“We were able to get the public infrastructure extensions done that clearly had a strong market appeal,” and the targeted businesses located there, said Miller, who is still on the job.

But not all TIFs produce the results promised: In Millinocket, a TIF awarded to a paper company in 2001 and inherited by successive owners required the owners to keep 630 workers working at the mill in exchange for almost $2 million dollars in property tax reimbursement. Down to a skeleton staff in 2003, the owners went back to the city council and successfully petitioned to keep the TIF even though they were unable to meet its terms.

Maine’s business community maintains that TIFs are essential tools for making the state attractive to investors.

“When we have so many companies owned by out-of-state or out-of-the-country corporations, or we are competing with a sister plant in another state, quite often when it comes to investments, those incentives make a difference,” said Dana Connors, head of the Maine Chamber of Commerce.

TIFs, said Connors, have “proven to be an advantage.”

How TIFs work

Cities, towns, plantations and counties create and administer TIFs, while the state Department of Economic and Community Development (DECD) must approve each TIF.

Maine’s early TIFs worked like this:

• To entice a developer to an unattractive property, the town designates the property as a TIF district.

• Under the TIF agreement, which lasts for as long as 30 years, the town agrees to use the taxes paid on the improved property for infrastructure improvements. Bonds may be used for the upfront costs, and taxes pay off the bonds. The development’s property tax can also pay for economic development programs.

• The amount of state aid for schools and services that municipalities get is based in part on the dollar value of all the property in the town, as are a town’s county taxes. The higher the town’s valuation, the less state aid will be awarded and the more county taxes will be owed. But under a TIF, the new development’s increased property value is not counted in the town’s total valuation during the TIF period, so revenue sharing and county taxes don’t change.

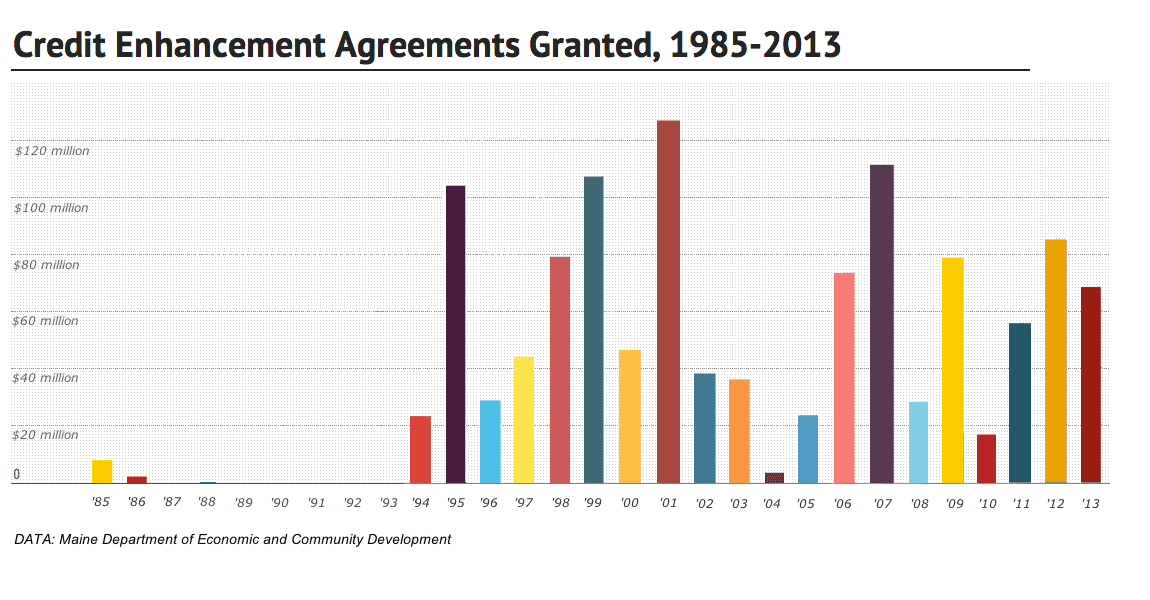

A second wave of TIFs began in the 1990s, when so-called “credit enhancement agreements” began to be part of TIF deals.

A credit enhancement agreement means a portion or all of the taxes paid on new development are given back to the developer, who may use the money for improvements to the project or put it to some unspecified use. Essentially, taxpayers become a partner in the development. They get no equity in return, although they do get the tax payments once the TIF is over, in anywhere from five to 30 years.

From 1985-1994, $34 million in credit enhancements were granted to developers and businesses by Maine municipalities, according to state records. Credit enhancements took off in the 1990s and 2000s, when $1.15 billion were granted.

While many credit enhancement agreements simply give taxes back to developers, some of them have been used to minimize the risk to taxpayers by requiring the developer to pay for improvements rather than have them paid for by a municipal bond. Once the developer makes those improvements, the town re-pays the developer out of the property taxes.

“Then you have the private company or individual bearing the risk rather than the taxpayer,” said developer Kevin Mattson, who has used TIFs to help finance a handful of projects across the state.

Credit enhancement agreements can effectively transform taxpayers into bankers.

The credit enhancement is “gap financing,” said Daniel Stevenson, Biddeford’s economic development director who was in charge of state tax incentive programs between 2006-2008. It’s “money going back to a business owner or developer to offset costs to actually make the deal happen.”

In 1997, the city of Bath voted to give back $81 million in a TIF to Bath Iron Works for its shipyard expansion, which the Portland Press Herald wrote “would help pay off loans needed for the expansion.”

In 2011, Portland agreed to return $31.5 million in a TIF to a project at Thompson’s Point that included a concert hall and hotel and office space. The Thompson’s Point developers told city officials that the project could not go ahead without the tax rebate because the site posed construction problems requiring expensive solutions.

While some credit enhancement tax credits are conditional, tying the reimbursements to investment levels, job salaries or site improvements, some, like the BIW and Thompson’s Point deals, are straightforward subsidies to the developer (BIW used a small percentage of the TIF to do infrastructure improvements). That leads Delogu to charge that the public is being forced to “underwrite the capital investment costs of private sector enterprises.”

“The credit that is being enhanced is the credit of the applicant,” Delogu said.

Mattson, the developer, also has concerns about the liberal use of credit enhancement agreements.

“In the old days, TIFs used to be very straightforward,” Mattson said. The idea behind them was: “We need to put infrastructure in for this project, can we get the taxes that this project generates to pay for them?”

But the current version of TIFs-with-credit-enhancements, said Mattson, “are a great tool that could be easily abused in a community.”

Town officials may be under pressure, for example, to give in to a company’s demands for tax money if the company is the largest employer in that town and is threatening to close down or move away.

“When you’re dealing under duress with the TIF, that’s a problem,” said Mattson.

“There are TIFs that pay money back that are unrestricted. Wow.”

But, giving that money back to developers and businesses, said Biddeford economic development official Stevenson, is one of the few ways Maine’s municipalities can attract economic development.

“In order for Maine to be competitive with other states, we have a very small toolbox in order to leverage enough tools together to make a deal happen,” he said. “In the city of Biddeford, we can barely pull these projects together…. Access to capital is more and more difficult.”

That, however, overlooks the tools the state has to help cities attract businesses, from business equipment tax exemptions to sales tax exemptions to rebated income taxes and other programs.

Legislators are considering reducing state business tax subsidies by $40 million this year, referring to such programs as the state’s “secret budget” that costs half a billion dollars a year. And that number does not take into account the TIF program.