MACHIAS — Washington County commissioners approved the 2026 tax assessments and signed a letter Thursday that is to be sent to municipalities, tribal governments and unorganized territories outlining the taxes due.

Some towns, including Alexander and Talmadge, will see nominal tax increases of less than $2,000. Others — including Addison, Baileyville, Calais, Eastport, Lubec, Milbridge and Steuben — will face increases exceeding $100,000.

Addison and Steuben will see the largest tax increases because their property valuations — though incremental — rose more than those of other towns for 2026. Addison’s valuation increased 0.48 percent and Steuben’s rose 0.43 percent, resulting in tax increases of $132,306 and $143,303, respectively.

The increases bring Addison’s total county tax bill to $535,944 and Steuben’s to $639,562, placing both among the top 10 municipal taxpayers in Washington County, along with Baileyville, Calais, Eastport, Jonesport, Lubec, Machias, Machiasport and Milbridge.

The letter from commissioners opens with a “thank you” for municipalities’ “continued involvement in the county’s activities and encouragement to our positive trajectory forward.”

The letter explains that the tax assessments will cover the $11.6 million budget for fiscal 2026, along with an additional $231,452 allowed under state law — an amount equal to 2 percent of the approved budget — and will bring the total tax assessment to $11.8 million.

The letter also reminds municipalities that have already prepaid their portion of the outstanding 2025 tax anticipation note — or those planning to do so and carrying a negative balance on that TAN — to deduct that negative amount from their 2026 taxes.

Those that have not prepaid — including the unorganized territories and the Passamaquoddy Nation — are being asked to add their portion of the 2025 TAN debt, with interest, to their 2026 tax payments. Those calculations are not included in the letters going out to those towns, so they must contact the county’s finance department to determine the full amount owed.

Municipalities are also being asked to consider dividing their tax payments into installments throughout the year, rather than waiting until the Sept. 1 due date, to reduce the interest the county will pay on the 2026 TAN.

Payments made 60 days or more past the September due date will be assessed a 5 percent interest penalty.

At Thursday’s meeting, commissioners had hoped to calculate how much the county would need to pay off the 2025 TAN to Machias Savings Bank, but not all municipalities have decided whether they will prepay their share of the debt. Two towns have meetings scheduled this week, so the county will not know its final payment until next week.

Provisional Treasurer Grace Falzarano said she hopes to have a full accounting of what will remain of the 2025 TAN by Feb. 12. The final payment is due Feb. 20.

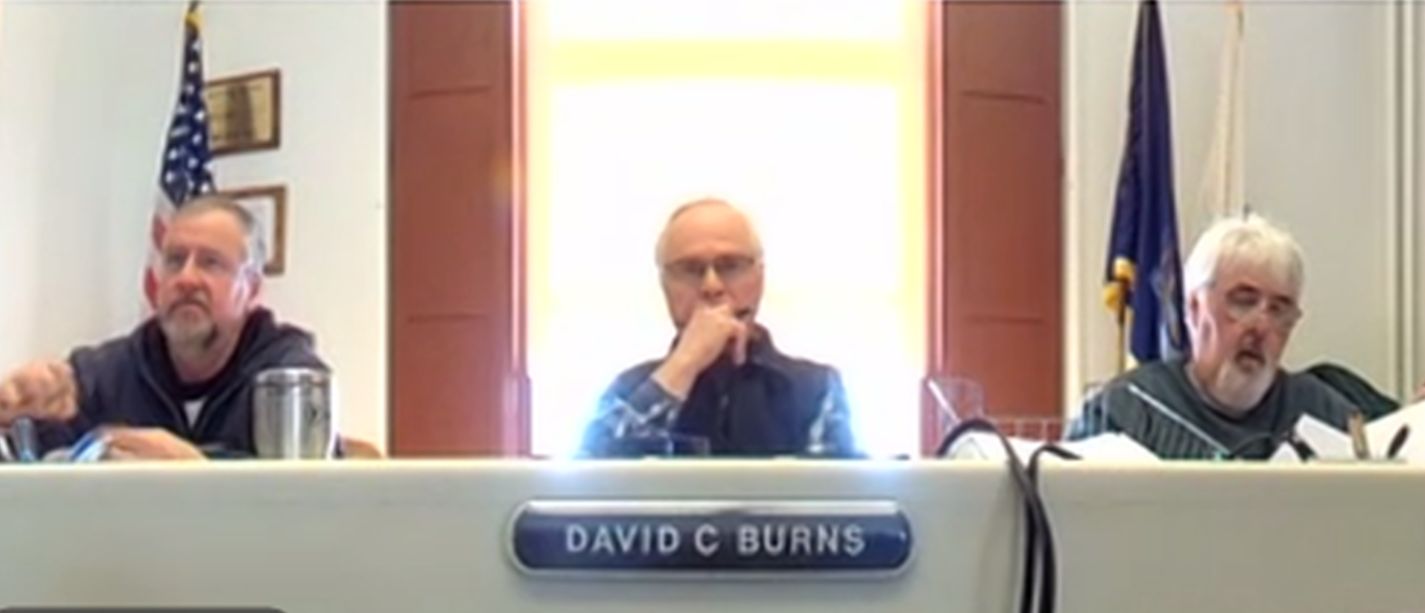

Commission Chairman David Burns said he thought that timeline was a little tight, but Falzarano said she has been in regular contact with bank officials and plans to schedule a meeting to discuss the final payment next week or the following week.

Commissioners agreed to hold off calculating a final payment figure until after that meeting with the bank and plan to take the issue up again at their next regular meeting in February.

In other matters, the commission took a formal vote to hold department spending to individual budget lines, rather than allowing department heads to overdraw one line as long as they stay within their department’s overall budget, as has been done in the past.

One of the issues flagged in the recently completed 2022 audit was overspending on line items across multiple departments, a problem the report said needed correction.

Commissioner Billy Howard raised the issue because the commission discussed line‑item spending at its meeting in early January, but did not vote to require department heads to seek approval if they plan to spend beyond individual line items.

Commissioner Courtney Hammond raised a concern that holding department heads to individual budget lines “pigeonholes us” in cases of unanticipated or emergency spending, noting that in past years department heads — while they may have exceeded specific lines — have “never overrun their budgets.”

Hammond cautioned against creating a situation in which department heads would look at their budgets “with fear if they’re going to overrun a line if they’re not going to overrun the budget.”

Howard pushed back, saying “For me, as a taxpayer looking at this, looking at the (2025) overruns, that we had that much flop in the budget, and that tells me we’re getting too much from taxpayers.”

He urged the commission to hold spending to approved budget lines.

“I just think we need to go within the line and stay within it,” Howard said, particularly as the county works to repair public trust in its financial management.

The commission ultimately voted to hold to line‑item spending, with Burns suggesting that “if it’s going to be a giant headache, we can reevaluate it, and if it’s going to prevent legitimate expenditures, we can revisit that.”

He assured the department heads in the room, including those from the jail and the Washington County Sheriff’s Office, that “if we see a line in any department that looks like it is in jeopardy, we’ll look at it” to evaluate further spending.

“I don’t think anybody has an intent of saying that if it’s not a legitimate expense we’re not going to support it,” Burns said. “That’s why we have budgets — to try to follow them.”

As part of the 2026 budget, commissioners funded additional accounting support for the county’s finance department. They reviewed three proposals Thursday to provide those services.

The offers came from BerryDunn, a certified accounting and management firm in Portland; Andrea White of LG&H, an accounting firm in Bangor; and Hank Farrah Consulting in Windham.

The BerryDunn offer came in as a $25,000 retainer, plus travel and other expenses; White’s offer was between $25,000 and $30,000 over three years, plus mileage and lodging; and the Farrah offer was between $13,000 and $16,000, plus mileage and lodging in 2026.

The commission agreed to reach out to Farrah to confirm his interest in the work. If he is not willing to commit to his offer, commissioners said they will seek bids through a formal process that requests proposals.

In his letter of interest, Farrah said he would organize and prepare financial statements, but his work should not be considered a formal financial audit or an effort to search for fraud, abuse or waste.