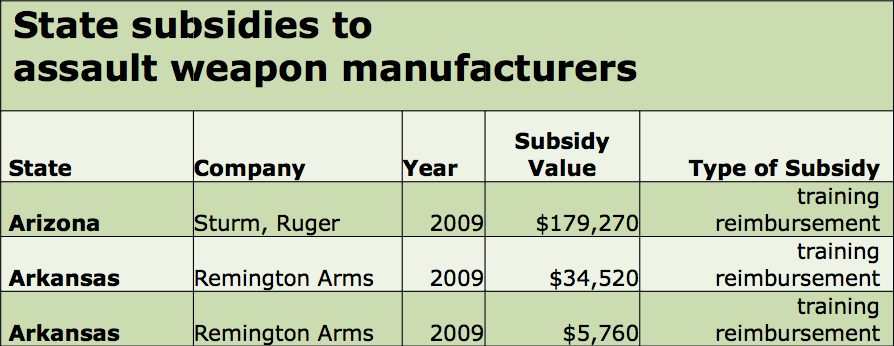

Taxpayers across the country are subsidizing the manufacturers of assault rifles used in multiple mass killings, including the massacre of 20 children and six adults at an elementary school in Newtown, Conn. last month.

A Maine Center for Public Interest Reporting examination of tax records shows that five companies that make semi-automatic rifles have received more than $19 million in tax breaks, most within with the past five years.

“I feel horrified at the power of the gun industry over our political system, that it could exert such influence,” said Newtown resident Barbara Richardson, who lives between the homes of one of the 6-year-old victims and the shooter.

Saying she respects hunters who are ethical and good neighbors, she “absolutely [does] not” support taxpayer subsidies to help manufacture assault rifles: “They’re weapons of mass destruction.”

Any new jobs due to tax subsidies are “not worth it,” said Richardson, a nurse whose first patient ever was a 19-year-old accidentally shot by his 13-year-old brother with their father’s gun.

The states providing the subsidies since 2003: Arizona, Arkansas, Florida, Kentucky, Maine, Massachusetts, New Hampshire, New York and Oklahoma.

Officials point out that such tax breaks are generally given to a range of businesses, not only to gun manufacturers, in the belief by state legislators and governors that they will attract industry or create or retain jobs.

One of the tax breaks that went to a Smith & Wesson plant in Maine was based on a program initiated by then-Gov. Angus King, now the senator-elect from that state.

King, in an email to the Center, said, “Various tax incentive programs have been enacted over the years in Maine and virtually every other state to encourage and support job creation, particularly in the manufacturing sector. No one suggested at the time these programs were created — or since, as far as I know — that the government should decide which particular businesses within broad categories would be more or less desirable.”

Yet many economists have thrown cold water on the idea that these programs create any net new jobs.

Kim Rueben, an economist with the Tax Policy Center in Washington, said, in most cases there is no increase in the numbers of jobs; instead, she said, such programs encourage businesses to move to the state with the best subsidies.

Sen.-elect King pointed out that the Maine Smith & Wesson plant doesn’t make semi-automatic rifles (it does make semi-automatic handguns).

But Rueben, the economist, countered that any savings, such as tax reductions, “go to the bottom line” of a publicly-held company such as Smith & Wesson, regardless of the origin of the subsidy.

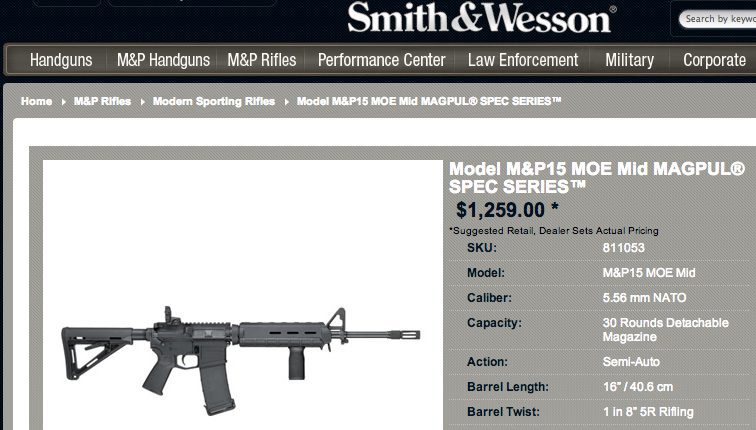

The vast majority of the subsidies went to two of the largest and most recognized arms makers in the country’s history: Remington, which got $11.9 million from four states, and Smith & Wesson, which got more than $6.7 million from two states.

How many assault-style rifles the two manufacturers make is unknown because they do not break out statistics for assault rifles from other rifles, according to a declaration in a 2009 civil case by a research coordinator for the National Rifle Association.

However, Mark Overstreet characterized Remington’s and Smith & Wesson’s assault rifle production as “prolific.” Overstreet testified that the dozen manufacturers that did break out their numbers had made 1.6 million assault rifles between 1986 and 2007.

The other assault rifle makers that got state tax subsidies were Sturm, Ruger; Kel-TecCNC Industries; and Bushmaster, which police say was the make used in the Newtown shootings.

The types of subsidies include tax credits, grants, rebates, reimbursements for training and property tax abatements.

‘Disturbing’

“I think it would be disturbing to people to know that they are essentially subsidizing the manufacture of these guns,” said Cathie Whittenburg, the Maine-based spokesperson of States United to Prevent Gun Violence, a national non-profit organization. “It’s certainly not something I want to be doing.”

Ladd Everitt of the Coalition to Stop Gun Violence predicted that the public will “react very angrily to” taxpayers subsidizing assault weapons.

“Finally, after decades, we are having a serious conversation, and with this conversation is coming invaluable education about what politicians are actually doing,” said Everitt.

The Center’s findings are based on a comparison of the known makes of semi-automatic rifles with state records and the “Subsidy Tracker” data base compiled by the Washington-based organization Good Jobs First. A Good Jobs First spokesman said while its database is the most extensive available, it is not comprehensive.

Semi-automatic rifles, often also referred to as AR-15s, were used not only by Adam Lanza at the Sandy Hook Elementary School on Dec. 14, but also in the Christmas Eve shooting in Webster, NY by William Spengler, a 62-year-old ex-con who killed two firefighters and wounded two others. Both Lanza and Spengler also killed themselves.

Excluding the recent New York shooting, Mother Jones magazine has reported that since 1982, there have been at least 62 mass murders using firearms in the country, in 30 states. Assault weapons like the AR-15s were involved in more than half of those shootings.

Smith & Wesson, one of the two largest recipients of state tax subsidies, did not respond to repeated requests for comment about the subsidies granted to the company.

Remington Arms, the other large recipient of subsidies, responded through a spokesman for its owner, the Freedom Group, by emailing a link to a publication, “Firearms and Ammunition Industry Economic Impact Report 2012.” The publication was produced by the gun industry’s trade association, the National Shooting Sports Foundation.

“For your story, you may want to include the following firearms industry economic impact data,” wrote Teddy Novin, Freedom Group’s director of public affairs.

The study details the industry’s jobs numbers for 2011: 98,752 employed by gun manufacturers, with an additional 110,998 jobs in “supplier and ancillary industries.”

“In fact, in 2012 the firearms and ammunition industry was responsible for as much as $31.84 billion in total economic activity in the country,” write the study’s authors.

Maine senator: no red flag

In Maine, Smith & Wesson has received two types of tax subsidies. From 2008-2010, it received $107,120 from the Employment Tax Increment Financing (ETIF) a program the state says encourages businesses to hire new employees by refunding from 30-80 percent of the state withholding taxes paid by the business for up to ten years.

Smith & Wesson’s plant in Houlton also received $51,671 in abatements for property tax on its equipment under the Business Equipment Tax Reimbursement program, initiated by King.

The Bangor Daily News recently reported that Smith & Wesson officials say it has invested $3.3 million in the past three years in its Houlton plant and the payroll has grown to $4.2 million.

Bushmaster, maker of one of the most well-known assault rifles, was located in Windham. The plant closed in March 2011, when its owner, Freedom Group, moved the operation to New York. Freedom also owns Remington. In 2010, Bushmaster was exempted from paying $2,405 in taxes on its business equipment under BETR.

State Rep. Adam Goode, D-Bangor, co-chair of the legislature’s taxation committee, said, “There are lots of different tax breaks and credits that … lots that people may be outraged about. My goal … would be for the legislature to have a conversation about tax breaks and how we evaluate them and how effective they are.”

The Senate co-chair of the committee, Anne Haskell, D-Portland, said the state police purchased Bushmaster rifles from the company when it was based in Maine.

“The fact that we’re providing a tax break to a company that’s providing jobs and high quality firearms to our state police doesn’t raise a red flag for me,” Haskell said.

Massachusetts’ $6 million deal

In 2010, Massachusetts approved $6 million in tax breaks to Smith & Wesson, which announced it would move its Thompson/Center hunting rifle division from New Hampshire to Springfield. The move meant an expansion of the firm’s Springfield headquarters and the addition of 225 jobs there.

James Debney, president of Smith & Wesson, said the company chose the Bay State over several other states because local and state officials, including Gov. Deval Patrick, “collaborated … to make our choice clear.”

Locally, the company got a $600,000 tax break from Springfield on top of the state’s $6 million.

“It’s a big win for the city — 225 jobs and $14 million (in investments) this year alone,” John D. Judge, the city’s chief development officer, told the Springfield Republican.

New York: public good?

Remington Arms received $5.5 million in New York subsidies and grants since 2007. The company was founded in Ilion, NY in the early 1800s and its purchase by Cerberus Capital Management, which owns the Freedom Group, was announced in April 2007. Almost $4.5 million of the subsidies were targeted at luring 200 jobs to Ilion from Remington and Cerberus-affiliated manufacturing plants in Massachusetts and Connecticut.

The subsidies became an issue in 2012 when Remington and another subsidized New York gun manufacturer, Kimber Manufacturing, fought against proposed state legislation that mandated microstamping for bullet casings, which gun control advocates and police said would help solve gun crimes.

The gun-control advocacy group New Yorkers Against Gun Violence (NYAGV), said that the gun companies’ opposition to the legislation meant they weren’t serving the public interest.

Jackie Hilly, executive director of NYAGV, said, “I do have a problem with people who are taking money from the state … and then flatly refusing to serve some sort of public good. That’s public money that’s being used, and I think there should be some kind of public good that comes out of it.”

Kentucky: 100 new jobs

Kentucky granted Smith & Wesson $6.1 million in subsidies since 1998, including, $4.5 million to subsidize the expansion of the company’s Graves County facility, where it planned to add 100 jobs.

Gov. Steve Beshear’s office did not return phone calls asking for comment on the subsidies. But at the time the grant was made, Beshear said, “The creation of 100 new jobs and a $5 million investment in the Commonwealth will have a tremendous impact and is a testament to our ongoing commitment to support our existing industries.”

Newtown: shift in thinking

A college student having coffee at Starbucks in Newtown last week said that while she doesn’t like subsidizing assault-rifle makers, she knows there are other Americans who don’t like funding programs she and her friends care about.

“I don’t understand someone’s need to own an assault weapon,” said Mary Hamula, 18, of Newtown. “If this hadn’t happened, I wouldn’t have a huge problem with tax subsidies. I’m a big proponent of government-subsidized healthcare.”

But she felt that public opinion might shift support away from tax subsidies for assault weapons.

“I think with everything that happened in Newtown, I think the culture around guns is going to change. If something positive comes out of it, that’s all we can ask for,” she said. “It did break us. Nobody here wants that to happen to another community.”

Theresa Sullivan Barger contributed to this story.